The signing of four pivotal bills on 26 June 2025, most notably the Nigeria Tax Act (NTA), 2025 , marked a watershed moment for Africa’s largest economy. Slated to take full effect in January 2026 , this legislation represents the Nigerian government’s boldest attempt yet to overhaul a tax system long characterised by fragmentation, complexity, and low compliance rates. The reforms—which also include the “Nigeria Tax Administration Act” (NTAA), “Nigeria Revenue Service Act” (NRSA), and “Joint Revenue Board Act” (JRBA) —aim to achieve two primary objectives: simplify the fiscal landscape to enhance the ease of doing business and modernise revenue collection, particularly by capturing the expanding digital space.

While the laws promise a fairer, more efficient tax system , the mood among Nigeria’s businesses and citizens is one of cautious optimism, blending relief over significant tax cuts with apprehension over new regulatory demands and systemic economic challenges.

A Unified Fiscal Blueprint: The Mandate for Modernisation

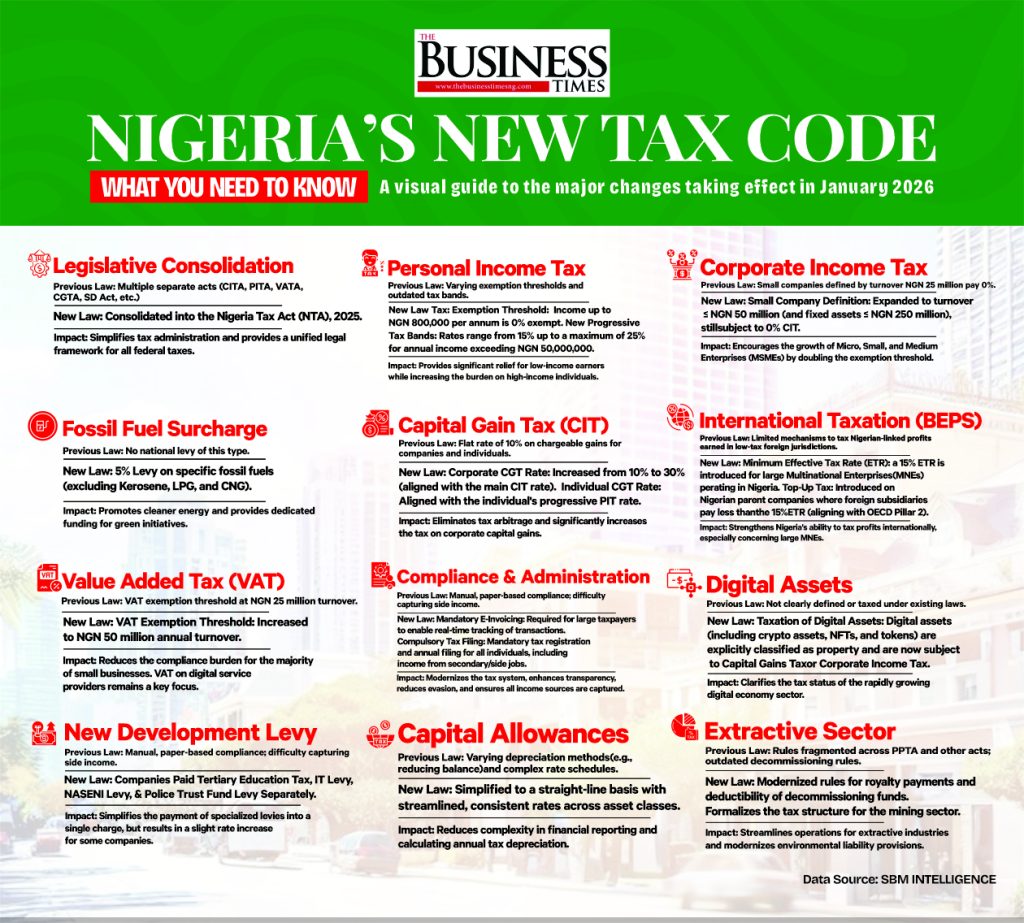

The core of the NTA 2025, is a sweeping legislative consolidation, merging over a dozen existing federal tax laws—including the Corporate Income Tax Act (CITA), Personal Income Tax Act (PITA), and Capital Gains Tax Act (CGTA)—into a single, unified legal framework. This foundational change is expected to eliminate the confusion, overlap, and administrative burden that has plagued taxpayers , significantly reducing compliance costs, particularly for the Micro, Small, and Medium Enterprises (MSMEs).

Beyond consolidation, the Act introduces a more progressive tax structure:

Personal Income Tax (PIT): The tax exemption threshold for annual income has been raised substantially to NGN800,000, offering financial relief to low-income earners, many of whom are owners of informal micro-businesses. New progressive tax bands cap the maximum rate for high-income earners at 25%. Low-income earners have welcomed these lower tax rates and exemptions that reduce their financial strain.

Corporate Levies: The issue of multiple levies has been streamlined, with four previous earmarked taxes subsumed into a single, unified Development Levy of 4% of assessable profits for all non-small companies.

Digital Economy: In a nod to modern realities, the NTA explicitly brings fiscal policy into the 21st century by classifying digital assets—including cryptocurrencies and Non-Fungible Tokens (NFTs)—as taxable property. For companies, the corporate CGT rate was increased from 10% to 30%, aligning it with the standard CIT rate to curb tax arbitrage opportunities.

This modern focus on digital income aligns with the views of analysts who have identified inefficiencies in the taxation of digital companies and the need to adapt tax policy to the digital age. Ikemesit Effiong, partner at SBM Intelligence, advocated for measures to increase revenue, including improving tax collection from digital incomes and taxing foreign investment at source.

An Unprecedented Anchor for MSMEs

The most consequential shift for Nigeria’s entrepreneurial class is the targeted relief delivered to small businesses. The definition of a “small company” eligible for 0% Corporate Income Tax (CIT) has been dramatically expanded. The turnover threshold has been significantly raised from the previous NGN25 million to NGN100 million, with fixed assets not exceeding NGN250 million.

This quadrupling of the exemption limit provides an unprecedented opportunity for thousands of small companies to retain 100% of their business profits for reinvestment. Furthermore, these small companies are explicitly exempt from the new 4% Development Levy.

Tosin Adepoju, CEO of Promaket Links and Services, acknowledged the concession of the tax exemption for businesses with annual turnovers below NGN100 million. However, Adepoju cautioned that “Tax cuts alone won’t spur growth… Rising logistics and material costs forced me to lay off staff at the beginning of this year… The government must prioritize affordable financing and make the economy better to truly support businesses”. Similarly, Omolabake, an online hair vendor, expressed skepticism, stating, “Tax exemptions are welcome, but I need easier access to loans to grow my business… The government must do more to help us scale”.

The Compliance Balancing Act and Citizen Skepticism

The NTA introduces new regulatory obligations, notably the mandatory tax registration and annual filing for all individuals, including those with part-time or gig income streams. Blessing Peters, a freelance writer and editor, views the requirement as fair, arguing, “Freelancers earn income, sometimes more than 9-to-5 workers… Paying taxes is reasonable, but we need to see these funds improve infrastructure and education, not line pockets. That’s what will ensure fairness”.

Despite the relief measures, the proposed tax stamps on excisable goods have provoked deep concern. Manufacturers argue that the compulsory physical stamp system will impose significant new costs, operational bottlenecks, and likely lead to higher consumer prices. Mr. Oritselaju, a pure water manufacturer in Ogun State, warned, “Tax stamps will raise production costs and prices, potentially cutting productivity by 40% and fueling illicit trade. Digital stamps would be a better fit for our digital age”.

The cautious rollout of e-invoicing—currently ring-fenced to only large taxpayers—is strategically sound, contrasting sharply with the immediate, universal compliance burdens seen in countries like Kenya. However, the debate over physical stamps highlights a critical risk: the potential for poorly drafted or implemented legislation to impede growth. This concern is shared by analysts such as SBM Intelligence’s Effiong, who noted that poorly conceived legislation, particularly when taxing the digital economy, could stifle investment and growth in the sector.

The Looming Threat of the Tax Stamp

Perhaps the most contentious element of the reform package is the government’s plan to introduce compulsory tax stamps on excisable goods. The Manufacturers Association of Nigeria (MAN) has been vocal in its opposition, warning of deep concern regarding increased compliance costs and inflation.

Manufacturers argue that a mandatory physical tax stamp system would impose significant new costs and operational bottlenecks, requiring investment in special machinery and slowing down factory lines. Small and medium enterprises are predicted to be hardest hit, with thinner margins making the difference between profitability and loss. Mr. Oritselaju, a pure water manufacturer in Ogun State, criticised the policy, stating, “Tax stamps will raise production costs and prices, potentially cutting productivity by 40% and fueling illicit trade. Digital stamps would be a better fit for our digital age”.

Industry leaders are urging the government to prioritise existing digital compliance systems, such as the Customs Automated Excise Register and e-invoicing platforms, rather than layering on another, potentially less effective, compliance burden.

This approach contrasts with the measured rollout of e-invoicing, which is wisely ring-fenced to only large taxpayers, preventing the imposition of a complex, high-cost compliance system on smaller businesses. This phased approach is a lesson learned from its East African peer, where Kenya’s universal e-invoicing rollout placed a heavy and immediate compliance cost on all MSMEs, regardless of size or digital readiness.

Global Context and A Plea for Transparency

Nigeria’s tax reform is part of a global movement to digitise tax administration and improve fiscal capacity. For instance, the NTA aligns with the OECD’s Pillar 2 framework by introducing a Minimum Effective Tax Rate (ETR) of 15% for large multinational groups, a defensive measure to protect revenue from sophisticated tax avoidance schemes. Furthermore, global models like India’s successful Presumptive Tax Scheme, which simplifies compliance by taxing a flat percentage of turnover for micro-businesses, could be further explored by Nigeria to complement the 0% CIT exemption.

Ultimately, the long-term success of the NTA, 2025, hinges not just on the letter of the law, but on careful, calibrated implementation, focusing on education and support. Samuel Oyekanmi, Research and Insight Lead at Norrenberger Financial Group, offered a balanced perspective, noting that while “E-invoicing simplifies tax filing and improves compliance… Nigeria’s low digitisation levels require tailored solutions that are befitting to our economy”.

Oyekanmi pinpointed the key barrier to tax participation: the pervasive lack of trust. “One major reason Nigerians hesitate to pay taxes is the lack of visible evidence of these funds in the economy,” he explained. “The government must demonstrate how taxes translate into concrete improvements, like better roads or schools. Transparency fosters patriotism and encourages compliance”.

The NTA, 2025, is a strategic investment in the future competitiveness and fiscal stability of the Nigerian economy. Its future will hinge on maintaining a delicate equilibrium—ensuring the promise of relief and modernisation is not undermined by complexity, new regulatory costs like the tax stamp, or a failure to translate taxes into tangible improvements for the citizens.